Energy consumers are on the move. As the renewable transition accelerates, the growing demand for clean electricity is changing the expectations and preferences that drive the market. How can energy suppliers adapt their business strategies to cope with shifting trends?

John Ravlo, Director of Partner Sales, and Patrick Lerud, Senior Key Account Manager, led a webinar detailing how the market is changing, what energy consumers are looking for and how electricity suppliers can connect with them. This is a summary of their talk.

An overview of trends in the renewable electricity market

Traditionally, suppliers were at the centre of the energy market. Retailers would buy wholesale electricity, add a margin, and sell it to the end consumer. “The best marketing element was a low margin above the wholesale market price,” John Ravlo explains. “However, even if that margin was small, it was still a cost for the consumer. And costs are best when they are zero.”

This approach was not only precarious for customers, who had to pay for the electricity supplier’s profit to keep the lights on and their businesses running, but also for retailers who had to crunch their margins to retain customers. “The future is not to sell costs, but value,” Ravlo continues.

The market is changing. “Four trends dominate today’s energy market,” Patrick Lerud explains. “We see a declining use of fossil fuels, a rapid expansion of renewables, increasing electrification, and a growing use of low carbon hydrogen.”

The relevance of PPAs is increasing

At the same time, Power Purchase Agreements (PPAs) are gaining market share, driven by declining technology costs and skyrocketing wholesale energy prices. “An obvious question one would ask themselves is: should I buy electricity from a supplier even if it is cheaper to get it through a PPA?” Lerud remarks.

The average duration of a PPA is 16 years. However, most contracts span 20 to 24 years. “This is because most agreements rely on solar technology, which has a long lifespan,” Lerud continues. Simultaneously, since wind is the most productive technology, it is used for larger PPAs.

Physical and financial PPAs dominate corporate electricity procurement in long-term contracts. “About 75% of the market is covered by PPAs and on-site self-supply,” Lerud says. “If you are an electricity provider, you already can only access 25% of the total market. Moreover, if you lose a customer to one of these long-term contracts, you will not recover them any time soon.”

How corporate action shapes the renewable electricity market

Initiatives like the RE100 are also influencing the market by putting more emphasis on PPAs. Recently, the corporate coalition introduced a new rule that limits the commissioning or repowering date of power plants to 15 years.

Members of the initiative who disclose the age of their chosen power plants procure renewable electricity from facilities that are, on average, ten years old. Typically, newer power plants have one or multiple PPAs in place. Meanwhile, older facilities normally sell unbundled Energy Attribute Certificates (EACs) only.

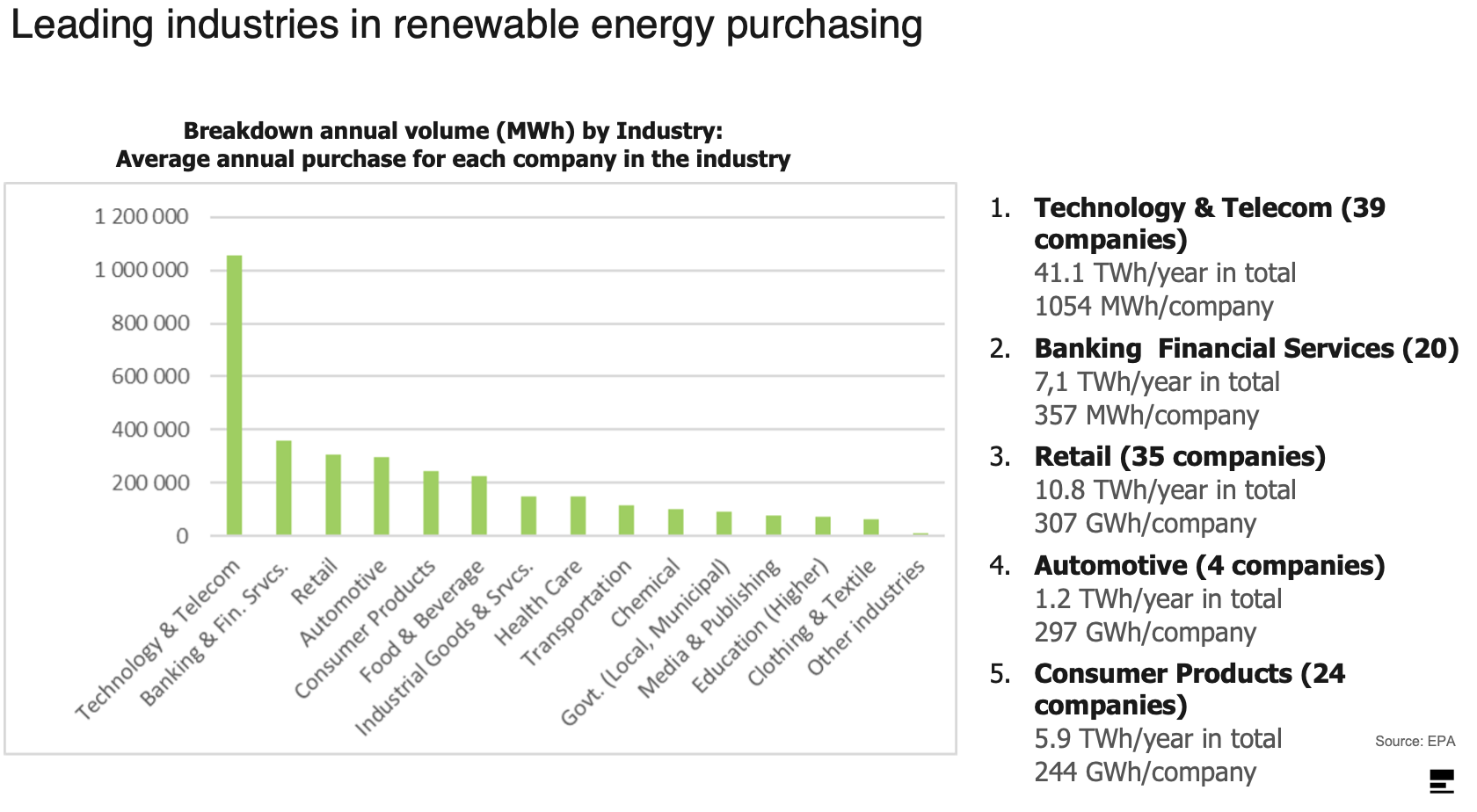

Clean energy procurement is not even across sectors. By the number of companies purchasing renewables, the leading segment is higher education – many universities have clean power programmes. However, when considering the volumes purchased, the technology and telecom industry dominates, led by Silicon Valley giants. The banking and financial services sector comes second according to these criteria.

Although on-site PPAs typically provide less than 20% of a company’s electricity consumption, they can be good marketing tools to signal your environmental commitment towards your stakeholders.

Create value: why companies buy renewable electricity

Beyond the value of electricity as a commodity necessary for business operations, analysis by Ecohz shows there are multiple reasons why organisations buy renewables.

“Companies often want to make an impact. They want to contribute to advancing renewable electricity and move towards a net zero target,” Ravlo explains. “They may also want to show civic leadership and enhance their public image with positive publicity”.

Renewable energy procurement can also show the company is focused on reducing future risks, thus attracting financial resources. “Organisations seek to build customer loyalty and enhance the value of their brands, as well as giving employees pride and attract highly talented individuals,” Ravlo continues. “In sum, a good renewable energy solution can improve the value of the whole organisation.”

Solutions for renewable energy suppliers

Considering the multiple benefits of renewables and the evolving requirements of corporate standards is essential for designing solid business plans. Many entities ––providers and consumers of clean electricity–– are creating their energy strategies accordingly.

In Luxembourg, for example, the authorities buy green energy certified as sustainably sourced by Ecohz Blue Power, a product that guarantees renewable electricity is produced according to the latest EU criteria on wildlife habitat, birds, and water protection. The energy is delivered through Enovos, a local electricity provider.

The City of Luxembourg sources sustainable electricity certified by Ecohz Blue Power.

In Seattle, local energy provider Puget Sound Energy invited over 30 companies in the area to form a partnership that would consume the entire output of a new wind park at a stable price via a green tariff delivered through the grid. The 15-year deal allowed the electricity supplier to keep customers by arranging a low-cost solution for multiple off-takers.

In another case, Silicon Valley Power, an electricity provider in Santa Clara, California, offered a programme to install solar panels at more than 60 local schools. While the corresponding EACs are sold away to other customers buying solar power, schools get electricity at affordable prices and an energy education programme for students.

The Norwegian Government Pension Fund Global, one of the largest sovereign wealth funds in the world, has invested over 200 million USD in the Japanese brewing company Asahi. The Norwegian pension fund has set net-zero targets for the companies it invests in and seeks out businesses committed to sustainability.

Ecohz works with Asahi as a renewable energy advisor. The partnership allowed the company to secure a 10-year PPA in Poland, which for power producer RWE resulted in the construction of the first Polish wind farm built without any subsidies.

Communicating renewable energy actions to attract customers and talent

Beyond reporting to corporate standards, such as CDP and the Science Based Targets initiative (SBTi), communication activities can be fundamental for attracting customers and highly skilled employees.

Tech company giant Apple is a prime example. Apple Park, the company's corporate headquarters in Cupertino, California, has become a symbol of Apple’s environmental policy – and an incentive for potential new employees.

Apple Park in Cupertino, California. Photo: Wikipedia

“When students at Stanford University, which is nearby, pass by the building covered with 46 000 solar panels. They start dreaming about working there,” John Ravlo says. For over a decade, Apple has been considered one of the best companies to work for.

Starbucks also innovated in customer-facing climate communication by creating an energy community with partners and employees. Along with an electricity supplier, Starbucks arranged a solar plant to deliver electricity to all its stores in New York City and offered customers the opportunity to become ‘partners’ of their strategy to reduce emissions.

Putting the consumer at the centre

To keep energy consumers captive and not lose them to potentially cheaper PPAs, the key, Ecohz advisors say, is to put the consumer at the centre of renewable energy strategies. The focus should be on generating value for companies that use power and their stakeholders.

“Energy partnerships, various forms of energy communities, combining on-site and off-site production, and innovative green tariffs can help energy suppliers retain customers and not lose them for a considerable period of time,” Ravlo continues.

Rethinking their services and creating added value could help energy suppliers adapt to a changing market. As renewables become the norm, making them an asset for communication, talent and customer retention, and community building could put providers at the forefront of the energy transition.

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)