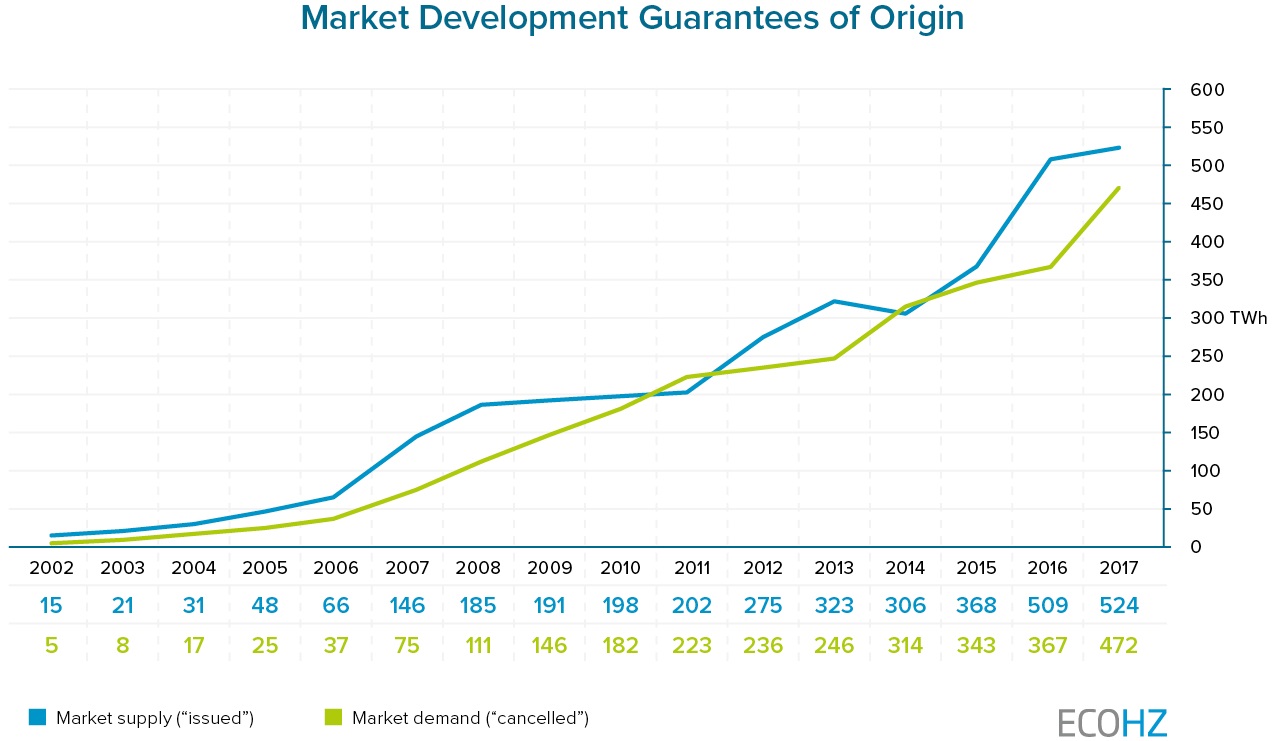

“Both available supply and market demand continue to grow, as we experience an increasingly healthy and robust market,” says Lindberg. Comparing year-to-date (YTD) supply and demand of Guarantees of Origin (GOs) for 2018 and 2017 show that supply is up by 45 TWh, while demand is up by 34 TWh.

“Historically the Guarantees of Origin market has had a higher supply than demand on an annual basis. Now we see this changing fast, and the market surplus has decreased significantly over the last two years. Behind this surge in demand are European consumers and climate active companies that are increasingly fulfilling their green energy intentions by documenting their renewable purchases.”

Italy and Switzerland with buoyant demand – reaching new heights

Both Italy and Switzerland reached record high levels for GO demand. Italian households and businesses have the highest ever volume – and have already in 2018 purchased 44.9 TWh, compared to 39.5 TWh in Q2 2017 – a 13.7% increase. Switzerland also surpasses its own record with 56.8 TWh year-to-date in 2018 compared to 51.1 TWh in Q2 2017 – an 11.2% increase.

Although a much smaller market, Iceland also has had an impressive 38.5% increase in GO demand in 2018 (3.6 TWh), compared to Q2 2017 (2.6 TWh).

“Norway was an early member of AIB, and its large hydroelectric production “dominated” the supply side of the Guarantees of Origin market for some years. While Norway’s production and Guarantees of Origin supply have been very stable (140 TWh in 2017), many new countries have contributed with sharp increases in the overall Guarantees of Origin supply,” says Tom Lindberg. This has resulted in a significant fall in Norway’s share of issued GOs – falling from around 60% in 2008 to 27% in 2017. “This is a healthy signal, and a significant development for the market – creating increased stability and more diversity,” says Lindberg.

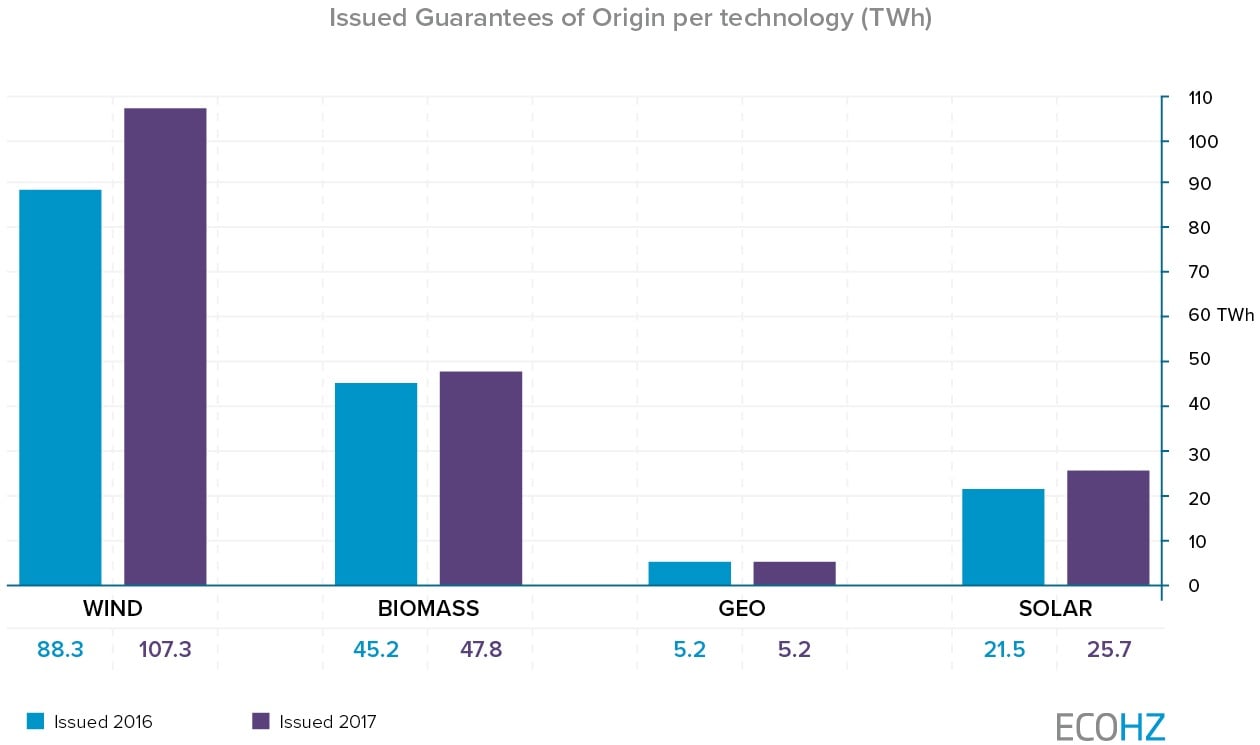

Wind and solar with greatest increase in supply

Hydropower has long been the most common technology of issued GOs in Europe. Hydropower is still a big share, but changes are occurring rapidly. Hydropower’s supply share fell from 79% in 2015, to 64% in 2017. “This change can primarily be explained by increased availability of solar and wind,” says Lindberg. Wind is increasing fast, from 11% in 2015, to 21% in 2017. Solar’s share is still small, but has grown from 1% in 2015, to 5% in 2017.

And this development is just the start – with much more to come the next years.

“Many countries currently limit the issuing of Guarantees of Origin from power plants that have received national support. As many of these power plants are either wind or solar, the result is a constricted supply of Guarantees of Origin from the newest technologies. This practice may change – either as a result of policy change, but also because of support systems being dismantled in many countries.

It’s also worth noting that many of the countries currently with a policy allowing issuing of GOs from power plants that receive contributions from national schemes like Holland and the Nordics, also are among the most attractive PPA markets in Europe today,” comments Lindberg.

More member countries expected to join

AIB, the pan-European marketplace connected to AIB’s electronic GO hub, currently totals 20 members. Lithuania, Latvia and Greece are all vying to be approved as new AIB members, most likely sometime late 2018 or early 2019. Poland, Serbia, and Bosnia, could be next in line, but full AIB membership will likely not happen until later in 2019.

“Every new member country that joins the AIB system brings both more demand and supply to the renewable energy market in Europe,” says Lindberg. “These additional member countries would represent a significant expansion for the European GO-system. Their membership will make the common market even more robust by aggregating pan-European supply and demand for renewable energy,” says Lindberg.

The above is a commentary based on figures published by AIB (Association of Issuing Bodies).

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)