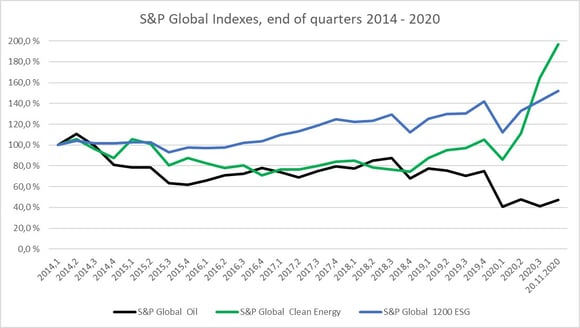

Various S&P Global Indexes indicate that investments in companies meeting sustainability criteria have given a better return than investments in companies not doing so. So far there has not been a common standard for ESG (Environmental, Social, Governance) reporting. New EU regulations will now give a standard for ESG reporting making it easier to identify real ESG companies. The new regulation is part of the EU plan to facilitate sustainable investments. Consumption and generation of renewable energy will influence the ESG reporting, so doing it in line with the requirements of the new reporting standard could increase the value of economic activities.

Table 1: The graph illustrates three S&P Global indexes from 2014 until today. Fossil and Clean Energy were quite similar until the end of 2018. Since then clean energy has outperformed fossil energy. Companies in the Global ESG-index have done better than fossil energy since the summer of 2014.

EU Taxonomy Regulation

So far there has been a lack of standardisation of definitions and processes of the ESG sector, but this summer the European Council and Parliament signed the EU Taxonomy Regulation. This new regime is dedicated to environmental considerations, but social and governance factors are planned to be included by the end of 2021. The reason for starting with an environmental classification system is to meet the approaching Paris Climate Agreement deadlines. The Taxonomy will in due course replace voluntary schemes with a single classification system for the EU.

EU will also adopt standardised processes through its Non-Financial Reporting Directive (NFDR) and Sustainable Finance Disclosure Regulation (SFDR). These measures form part of a broader suite of ESG initiatives designed to channel funding to genuinely sustainable, rather than greenwashed investments, facilitating compliance with the Paris Agreement climate targets and the EU’s commitment to adopt the United Nations (UNs) 2030 Sustainable Development Goals.

Non-Financial Reporting Directive (NFRD)

In summary, the Non-Financial Reporting Directive (NFRD) requires large EU “public interest” corporates (including many financial services firms) to publish data on the impact their activities have on ESG factors. The Taxonomy Regulation introduces a sustainability classification system through which investment firms must classify investments based on NFRD data (and other datasets). The SFDR (as supplemented by the Taxonomy) requires investment firms to disclose:

- The environmental sustainability of an investment and the provenance of any ESG claims made

- The risks investments present to ESG factors

- The risks ESG factors present to investments

Depending on the rule in question, the relevant SFDR disclosure will appear in one or more of the following locations: on the investment firm’s website, in periodic reports, in promotional material, and/or in pre-contractual documentation. The SFDR rules are further broken down into mandatory and “comply or explain” rules, as well as entity- and product-level rules.

Both the Taxonomy Regulation and the SFDR have enormous scope and application, covering more or less the entire asset management industry and beyond. Moreover, the Taxonomy applies directly to Member States, who are prohibited from introducing domestic rules that would compromise the integrity of the Taxonomy regime.

Together these new EU measures will have an impact far beyond the geographical boundary of the EU, shaping the flow of investments, the broader financial regulatory arena, and the working practices of many financial professionals.

Over the short term, there are no similar plans in the U.S. to adopt regulations to address the lack of standardisation in ESG definitions and processes. For the purposes of the Taxonomy regulation, an investment can be classified as an environmentally sustainable economic activity if it contributes substantially to minimum one out of six specified environmental objectives.

What does this mean for electricity suppliers and consumers?

For electricity suppliers and consumers, the climate change mitigation objective is very important. Article 10, 1 (a) of new Taxonomy Regulation will be of special interest as it specifies that an economic activity will qualify as contributing substantially to climate change mitigation through the avoidance or reduction of greenhouse gas emissions by generating or using renewable energy in line with Directive (EU) 2018/2001 (Renewable Energy Directive).

Electricity suppliers that plan to serve companies reporting their Environmental performance according to the Non-Financial Reporting Directive and the new Taxonomy regulation should be able to deliver electricity from renewable energy sources that qualify according to these regulations. Solutions should give the economic activity renewable energy with a low carbon footprint, and an impact beyond the consumption of using renewable energy in the sense of contributing to the production of more renewable energy.

Ecohz can contribute with competence and experience to advise and develop renewable electricity solutions, both for electricity suppliers and end-consumers, that fulfil the reporting regulations and give value to energy solutions. Companies can report substantial contribution to climate change mitigation and become more attractive as investments and business partners.

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)