Biomethane is a refined form of biogas made from the controlled decomposition of organic matter. It is identical in chemical composition to fossil methane, meaning it can be transported using existing infrastructure and does not require any technical changes for its use. It can also be produced and consumed sustainably, adding no CO2 into the atmosphere.

According to the REPowerEU plan, the block aims to increase annual biomethane production to over 350 TWh by 2030 to meet its emissions reduction targets. And although an important gap remains, the sector is accelerating.

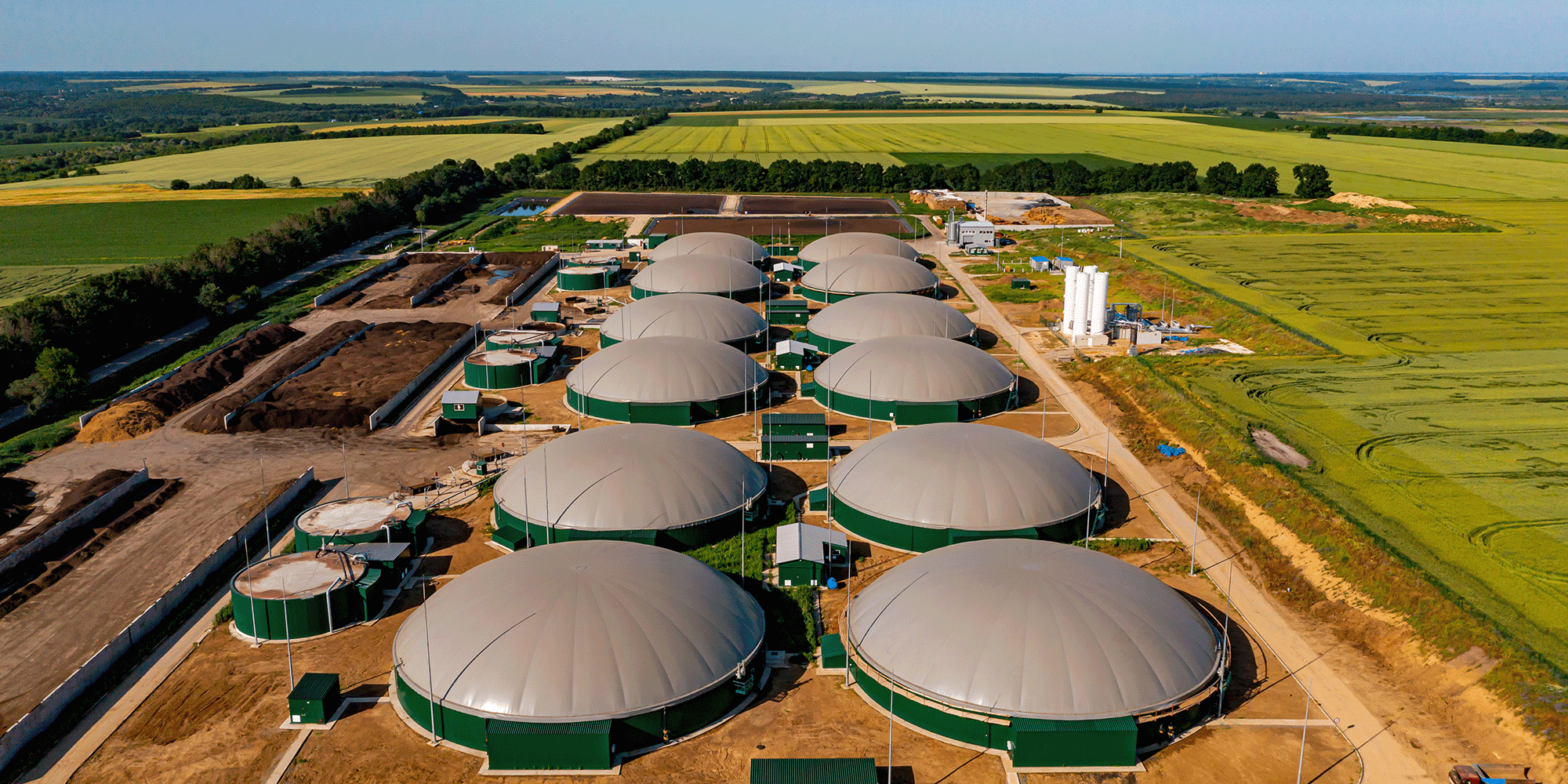

Biomethane production in Europe

“Three main factors determine biomethane production,” says Hugo Malfit, Senior Originator at Ecohz. “It depends on the availability of feedstocks, legislative support, and the share of biogas that is refined into biomethane.”

Not all the biogas produced in Europe is upgraded, or refined, into biomethane (to watch a 30-minute webinar on how biomethane is produced and used, click here). However, that share is increasing. Biogas production in the continent reached 234 TWh in 2023. At the same time, Europe produced 52 TWh of biomethane, an 18% increase from 2022 — the biggest jump in production to date.

Combined biomethane and biogas production in Europe (TWh) from 2011 to 2023. Source: EBA

Capacity expansion is underway. At the end of 2023, there were 1,510 biomethane plants in Europe. Italy, France, Denmark, and the United Kingdom showed the strongest growth in production in 2023. Meanwhile, Portugal, Lithuania and Ukraine have also started producing biomethane, for a total of 25 European countries with production facilities.

Meanwhile, demand has remained strong and more certified volumes are entering the market. “There is a lot of growth in the pipeline. The market needs more supportive policies to get it off the ground,” Hugo adds.

Towards a harmonised European biomethane market

Biomethane Guarantees of Origin (GOs) certify the renewable quality of gas. However, unlike the electricity system, there is not yet a harmonised European biomethane market that allows for the free transfer of Guarantees of Origin (GOs) and the Proof of Sustainability (POS), a certification by an independent third-party of the sustainability characteristics of biomethane.

Most countries have their own registries, where GOs are issued. But not all of them are connected in a way that allows for cross-border transfers. Yet, the Association of Issuing Bodies (AIB), the organisation for government-appointed GO issuers for electricity and gas in Europe, which oversees the system for electricity GOs, expects to have ten countries as gas members soon.

Biomethane in the Renewable Energy Directive

The Renewable Energy Directive (RED) pushes for greater unification and growth in the EU. In its latest revision (RED III), it recognises the potential of biomethane to replace large volumes previously imported from Russia. The previous revision (RED II) already introduced GOs for biomethane — which some countries have yet to implement — and required the creation of a Union Database as a single registry for European biomethane GOs and POS.

Simultaneously, more countries are harmonising the rules for the issuance and use of gas GOs and connecting to centralised hubs to allow imports and exports of biomethane certificates.

Why, where and how to use biomethane certificates

Companies can use biomethane certificates for voluntary and compliance purposes. Reporting to sustainability frameworks, such as CDP, is voluntary. Reporting under the Corporate Sustainability Reporting Directive (CSRD) or on emissions under the EU ETS falls under the mandatory umbrella.

“Different standards require different levels of stringency in your biomethane sourcing,” Net Zero Advisor Nils Holta explains. For instance, to demonstrate voluntary action, it may be sufficient for organisations to buy unbundled certificates – generic gas GOs that match physical gas volumes obtained from other sources.

Using biomethane under the EU Emissions Trading System (ETS)

The EU ETS has stricter requirements. It demands gas GOs bundled with physical volumes and POS issued by an EU-recognized voluntary scheme such as ISCC. Any cross-border flows must have mass balancing performed correctly, to ensure that national statistics reflect the trade in gas and renewable attributes. The CSRD relies on the same methodology, meaning companies under its scope must fulfil the EU ETS requirements.

Higher requirements, however, also make bundled GOs more expensive. “In simple terms, bundled EACs are pricier because they come with a package of GOs, POS and physical delivery of gas, or a proof that physical gas has been transferred,” Hugo Malfit explains.

Transferring GOs across borders may be an option to cut costs. “Provided there is a connection to the EU gas network, it is sometimes possible to buy GOs in a country where they are cheaper and cancel them for consumption in another country even if their registries are not connected,” Hugo Malfit continues. “However, these ex-domain cancellations are a temporary solution. As more countries connect to a single GO system, more options will become available for consumers.”

How can Ecohz help?

Ecohz provides cost-effective biomethane solutions to customers in almost every country in Europe, the USA, and across South America.

Ecohz provides cost-effective biomethane solutions to customers in almost every country in Europe, the USA, and across South America.

Ecohz holds an ISCC certification, which allows us to provide biomethane certificates for both voluntary and compliance purposes, including the reduction of obligations under the EU Emissions Trading System (ETS).

Our advisors also assist in setting up Biomethane Purchase Agreements (BPAs), which ensure availability at a stable price over an extended period, even in markets with limited supply.

Moreover, Ecohz provides personalised advisory services such as market analysis, assessment of needs on a case-by-case basis, and ongoing support. “We create customised plans that deliver your climate targets,” Nils Holta concludes. “We are here to help you use biomethane as part of your decarbonisation strategy.”

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)