Making sense of the reporting jungle requires a lot of reading and obtaining insights into various organizations, initiatives, and frameworks. The article will only touch the surface, meaning, I will stay focused on making you aware of the most common frameworks for reporting with brief definitions and links for further exploration.

Where to start?

Obtain an understanding of the various frameworks and measures that fits with your company’s overall strategy and sustainability targets – GHG protocol, CDP, RE100, EV100, SBTi, SDGs, UN’s Global Compact, GRI, PRI, IIRC, DJSI, CDSB, SASB, TCFD, Certified B Corporation, Poseidon Principles and more. According to the World Business Council for Sustainable Development (WBCSD), there are vast number of frameworks for non-financial reporting.

A good starting point for reporting requirements related to environmental, social and governance (ESG) is The Reporting Exchange (free sign up). It should be noted that some frameworks are purely focused towards investors (CDSB, TCFD, DJSI, SASB), some frameworks aim to satisfy both investors and wider audience (GRI, CDP), and some are solely wider audience (UN SDGs, IRRC, SBTi).

Most common frameworks

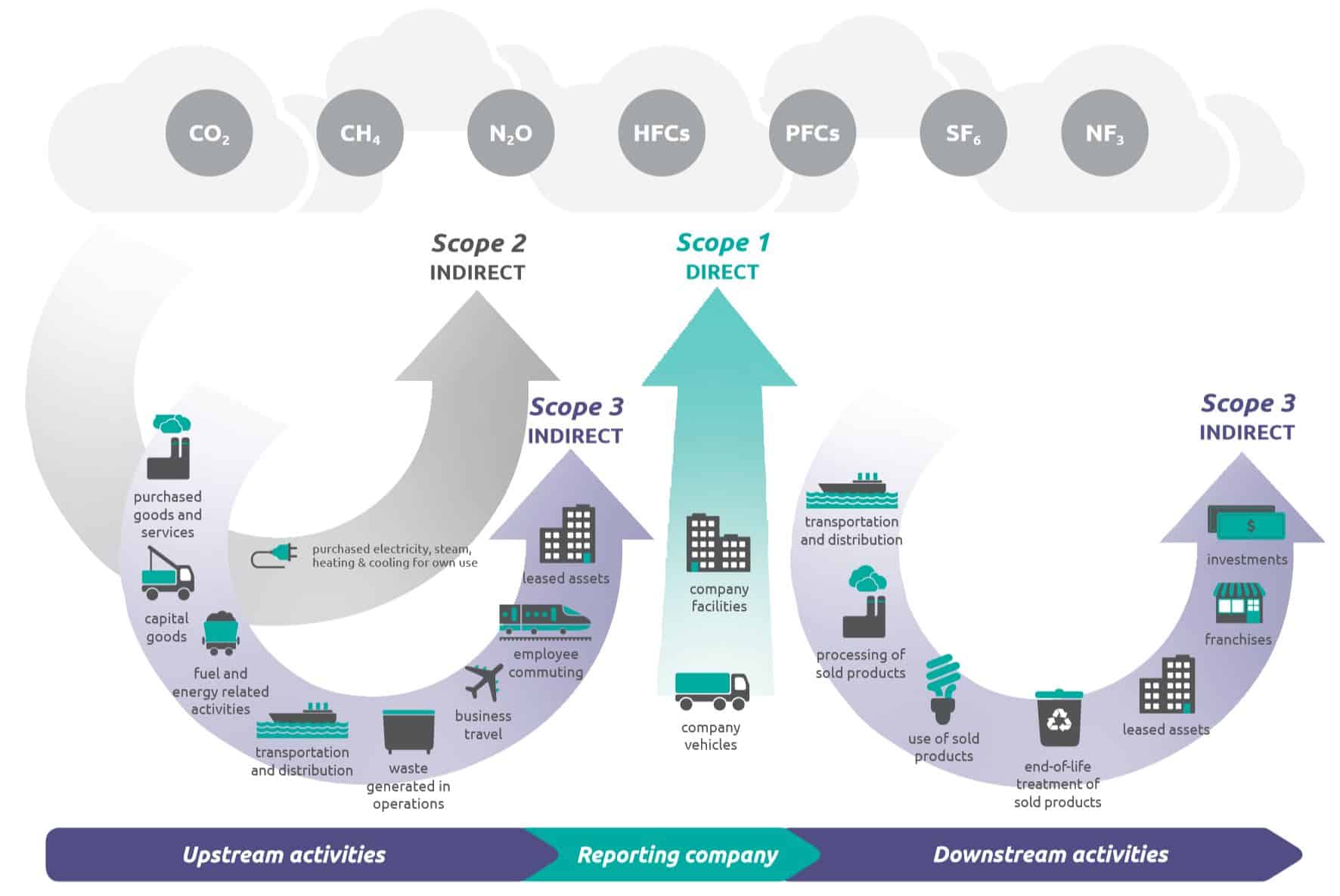

Greenhouse Gas protocol (GHG) is one of the most established accounting standards that is used as a basis for setting up a framework for measuring and reporting your carbon footprint. GHG reporting standards covers seven greenhouse gases. The figure below depicts 15 reporting categories for upstream and downstream activities related to GHG scopes.

CDP (formerly Carbon Disclosure Project) is a non-profit organisation that holds a global disclosure system that supports investors, companies, cities, states and regions in measuring and managing their risks and opportunities on climate change, water security and deforestation. “590 investors with over US$110 trillion in assets and 150+ large purchasers with over US$4 trillion in procurement spend are requesting thousands of companies to disclose their environmental data through CDP.” Climate related data for cities, states and regions are available on their data portal free of charge. Corporate data sets can be accessed at a cost. CDP celebrates corporate leadership on climate action and transparency with their famous annual A List.

RE100 is a global initiative providing a set of guidelines for energy buyers to ensure procurement of 100% renewable electricity. The organization work closely with their members on addressing market and policy barriers. RE100 operates with six policy measures, in which one of them is to “support a credible and transparent system for issuing, tracking, and certifying competitively priced” Energy Attribute Certificates (EACs). The initiative is led by the Climate Group in partnership with CDP.

EV100 is another Climate Group initiative with the aim to accelerate the transition to electric vehicles (EVs). We recently saw Volkswagen Group and bp announced their partnership to expand the infrastructure for EV charging across Europe. Last year Royal Mail Group signed a deal with EDF to deliver EV infrastructure for their fleet. BT Group (together with daughter company Openreach) made commitment to converting their commercial fleet to EVs by 2030. There are many great stories about companies moving their fossil fleet to fully electric as well as partnerships to ensure access to charging stations (duly documented with EACs – renewable electricity).

Science-Based Targets (SBTi) is an initiative that “provide a clearly-defined pathway for companies to reduce greenhouse gas emissions, helping prevent the worst impacts of climate change and future-proof business growth.” SBTi is a partnership between CDP, UN Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). SBTi offers a methodical and transparent process. Worth reading is SBTi’s 2.0 draft of its Corporate Net-Zero Standard for target-setting.

Sustainable Development Goals (SDGs) is a set of goals set forth by the United Nations with the intention to ensure a sustainable future. The goals represent 17 sustainable themes with 169 part goals, all to be achieved by 2030. “In June 1992, at the Earth Summit in Rio de Janeiro, Brazil, more than 178 countries adopted Agenda 21, a comprehensive plan of action to build a global partnership for sustainable development to improve human lives and protect the environment.” Many companies align a number of the SDGs with the company’s purpose and overall strategy.

United Nations Global Compact is a UN initiative that encourages companies to commit to sustainable and social responsible polices as well as reporting on implementation and progress. The initiative is built on ten principles. “By incorporating the Ten Principles of the UN Global Compact into strategies, policies and procedures, and establishing a culture of integrity, companies are not only upholding their basic responsibilities to people and planet, but also setting the stage for long-term success.” There are local chapters in which enable networking with like-minded in your country – share challenges and success stories.

Global Reporting Initiative (GRI) is an international independent standards organisation that support companies, governments and other organizations in understanding and communicating their impact on climate, human rights and corruption. GRI’s framework for sustainability reporting are widely used standards (free to public). The organization also acknowledge that industries differ in their impact on the climate, economy and community at large hence have also made available sector standards. GRI frameworks put emphasis on accountability and transparency. GRI 101 is set up to help companies getting started with the reporting process.

Principles for Responsible Investment (PRI) is an independent organization, in which “encourages investors to use responsible investment to enhance returns and better manage risks, but does not operate for its own profit; it engages with global policymakers but is not associated with any government; it is supported by, but not part of, the United Nations.” PRI offers reporting process, guidelines, data portal, investment tools, case studies, webinars and events to keep investors informed on how to integrate ESG into their investment strategies.

International Integrated Reporting Council (IIRC) is a global coalition of regulators, investors, companies, standard setters, the accounting profession, academia and NGOs. The coalition work towards aligning capital allocation and companies sustainability efforts via integrated reporting. “An integrated report is a concise communication about how an organization’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value in the short, medium and long term.”

Dow Jones Sustainability Index (DJSI) “is a global index consisting of the top 10% of the largest 2,500 stocks in the S&P Global Broad Market Index based on their sustainability and environmental practices.” The companies listed are reviewed on an annual basis to see if they follow the sustainability guidelines. Companies may be removed from the index based on a number of ethical exclusions as well as damaging reputation (in the media) related to ESG issues (human rights, labor disputes, workplace safety, illegal commercial activities, fraud, negative environmental impact).

Climate Disclosure Standards Board (CDSB) is an international consortium of business and environmental NGOs. The consortium provides a framework for reporting environmental information that can be integrated into mainstream reports. CDSB state that investors, analysts, companies, regulators, stock exchanges and accounting firms will benefit from their framework.

Sustainability Accounting Standards Board (SASB) “is an independent nonprofit organisation that sets standards to guide the disclosure of financially material sustainability information by companies to their investors. SASB Standards identify the subset of environmental, social, and governance (ESG) issues most relevant to financial performance in each of 77 industries. SASB also provides education and other resources that advance the use and understanding of its Standards.” I suggest you have a look at the organisation’s conceptual framework (currently under revision), in which provides insight into audience, core objectives, guiding principles, accounting metrics and more.

Task Force on Climate-Related Financial Disclosures (TCFD) “is an organisation that was established in December of 2015 with the goal of developing a set of voluntary climate-related financial risk disclosures which can be adopted by companies so that those companies can inform investors and other members of the public about the risks they face related to climate change. The organization was formed by the Financial Stability Board (FSB) as a means of coordinating disclosures among companies impacted by climate change.” I suggest you have a look at the TCFD’s status report from 2020 that deliver useful information about users feedback (effective climate-related financial disclosures including targets related to GHG emissions), reviewing implementation challenges, case studies on implementation, and initiatives supporting TCFD (including government and regulatory efforts). Interesting read on an oil major being pushed to adopt the TCFD framework.

Certified B Corporation is a private verification and certification administered by B Lab which has set up an ESG impact assessment. The certification is for companies that balances purpose and profit. Companies are tracked on their social and environmental performance in their pursuit for “positive impact for their employees, communities, and the environment.” The certification consists of three pillars: performance, legal and transparency.

Poseidon Principles is a framework for evaluating and disclosing climate alignment of financial institutions providing services to ship finance and the maritime industry. The principles are fully aligned with the International Maritime Organization’s (IMO) ambitions for GHG emissions reduction and decarbonization of shipping. The framework is built on four principles: assessment, accountability, enforcement and transparency.

Conclusion

Most of the larger companies have their reporting under control, but I hope that the overview of the various frameworks for reporting will be of help to the ones that are not familiar with the most common that are currently in use. The UK government have published a useful guide with frameworks for non-financial reporting. They have also made a list of FTSE 100 companies and their reporting practices (see page 132 onwards).

Worth noting is that last year, five of the larger organizations (CDP, CDSB, GRI, IIRC, SASB) announced that collaboration is key in a complex reporting world hence they set forth a common agenda for working together for improving sustainability reporting.

“ Transparent measurement and disclosure of sustainability performance is now considered to be a fundamental part of effective business management, and essential for preserving trust in the business as a force of good.”

A recent article by edie newsroom stated that “more than 20% of the world’s largest corporates, worth sales of more than $14trn, have now committed to net-zero targets, but more transparency and short-term targets are required to navigate potential greenwash issues.” A statement that supports the importance of ensuring credible reporting on the journey towards your net-zero target.

As a closing remark, Climate Action 100+ have newly released a benchmark report that measured the progress of large corporations with a net-zero target. “Almost three-quarters of the companies have committed to aligning with the Task Force for Climate-Related Financial Disclosures (TCFD) recommendations. However, only 10% use climate-scenario planning that includes the 1.5-degrees Celsius scenario and encompasses the entire company.” Read more about the findings in the edie article and review the full report.

Best wishes for your Easter holidays – a nice little break to get proper quality time with your family. Maybe enjoy outdoor activities and a couple of books (or gain insight on reporting!).

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)