A classification system of green businesses to facilitate green investment

In order to fund the European Green Deal and to meet its 2050 net zero goal, the European Commission has developed a comprehensive policy agenda on sustainable finance. This includes the 2018 Action Plan on Financing Sustainable Growth.

At the core of the Action Plan is the EU Taxonomy Regulation. The EU Taxonomy is a framework to facilitate sustainable investment. It aims to create a unified classification system of business activities that can be considered environmentally sustainable and define which activities that are “green” in a credible manner. If the market for green investments is to be credible, investors need an objective consideration of the sustainability of the companies in which they invest. The EU Taxonomy is an important step to channel investments into sustainable activities.

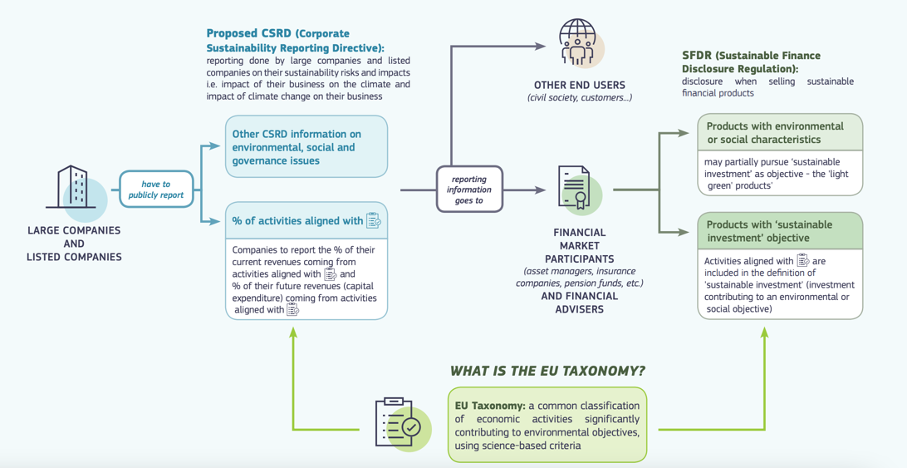

To understand the scope of the EU Taxonomy, a closer look at some existing regulations is needed. EU sustainability reporting differentiates between financial institutions and corporate companies.

Reporting for financial institutions

Financial institutions, including all asset managers, financial advisors, and insurance providers in the EU, are governed by the Sustainable Finance Disclosure Regulation (SFDR). They are required to report on the sustainability risks that may impact the company’s returns, in addition to how their investments may impact environmental and social factors. This dual reporting is called the “double materiality” principle.

Reporting for large and listed companies

European listed companies and companies with more than 500 employees must report according to the Non-Financial Reporting Directive (NFRD), which came into effect in 2018. The reporting must include efforts to protect the environment and social responsibility, among other ESG categories.

The reporting rules introduced by the NFDR established important principles for certain large companies to report sustainability information on an annual basis, but has, on the other hand, been criticized for setting too vague guidelines, allowing companies to hold back or highlight information in communication to their stakeholders. This lack of clear guidelines makes the reported information hard to compare from company to company. Investors increasingly need to know about the impact of companies on people and the environment, partly to meet their own disclosure requirements under the SFDR. In 2023, the NFRD will be replaced by the Corporate Sustainability Reporting Directive (CRSD). The CRSD will establish binding sustainability reporting standards that set scope and content and require the inclusion of Taxonomy aligned data and require third party verification of reported sustainability data. The CRSD will also include a greater part of the economy. The NFRD requires listed companies and companies with more than 500 employees to comply, leaving a significant portion of the economy to report non-financial information on a voluntary basis. The CRSD will require all listed companies and companies with over 250 employees to comply, significantly increasing the number of companies required to report.

Figure 1: Overview of how the disclosed information will flow based on the CSRD (replacing the NFRD), the SFRD and the EU Taxonomy (European Commission).

A high Taxonomy alignment can make companies more attractive

The Taxonomy covers all companies in scope for NFRD (becoming CSRD from 2023) and all financial market participants in scope for SFDR. Corporates will need to report the percentage of their turnover, capital expenditures and operational expenditures that are aligned with the EU Taxonomy. Asset managers will need to report the percentage of their portfolio that are invested in activities aligned with the EU Taxonomy. Companies and financial institutions disclose to what extent they are taxonomy aligned. If none, or only some of a company’s business activities fit in under the categories of the EU Taxonomy, a company is considered not, or only partly aligned with the Taxonomy. Activities aligned with the EU Taxonomy will be included in the definition of “sustainable investment” and labeled dark green. Some activities may not be included in the Taxonomy but might contribute to other ESG metrics reported with the CSRD (replacing the NFRD), giving a light green label. A high alignment percentage with the EU Taxonomy could improve companies’ reputation, making them more attractive to investors and creditors.

EU Taxonomy reporting starts in 2023

In 2022 companies under the NFRD must report on taxonomy eligibility, meaning reporting on the Taxonomy eligible categories it has activities in. Full reporting starts in 2023 for participants under the NFRD and in 2024 for participants under the SFDR, as the financial institutions under the SFDR are dependent on the results from the companies in order to report on their own Taxonomy alignment.

Applying the EU Taxonomy requires that a business activity meets four criteria:

|

Be eligible |

The activity reported needs to be taxonomy eligible. This means that it needs to fit into a category defined in the EU Taxonomy. |

|

Alignment |

To be taxonomy aligned, the activity needs to make a significant contribution to one or more climate objectives.

|

|

Do no significant harm (DNSH) |

The activity must not harm any of the other five climate objectives. |

|

Comply with minimum safeguards |

The activity must comply with minimum social and governance safeguards. |

Changing the sustainability reporting landscape

The EU Taxonomy is changing the sustainability reporting landscape by defining business activities as sustainable or not. It is making a clear classification system, which up until now has been lacking. This comprehensive framework will make it easier to compare sustainable businesses to unsustainable ones and reduce greenwashing. In this way, the EU Taxonomy may dictate the development of sustainability disclosing, next to providing a strong signal to investors and other stakeholders to assist their decision making and flow of investment.

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)