On 31 January 2023, Preben Munch, Director of Corporate Sales at Ecohz, and one of Ecohz’ PPA Advisors conducted a webinar discussing the variables that companies should factor in when contemplating a PPA in their decarbonisation efforts. This is a summary of their conversation.

What exactly is a PPA?

In the simplest terms, a PPA is an agreement to buy renewable electricity, often documented with Energy Attribute Certificates (EACs), at a convened price. PPAs are predicated on stability and certainty. While the electricity market is volatile, PPAs guarantee stable energy prices for an extended period of time, typically over ten years.

For power consumers, certainty provides hedging against fluctuating electricity prices that can affect business models and even threaten the viability of certain industries. For power producers, a guaranteed source of income facilitates building additional renewable energy capacity – for example, new wind and solar parks – by making it easier to obtain loans and other sources of financing. Thus, PPAs add clean power to the electricity mix and displace fossil fuels.

What are the different types of PPAs?

Physical and financial PPAs

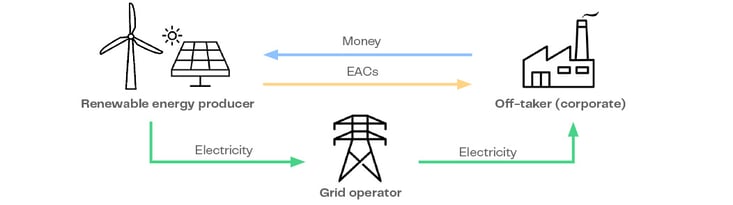

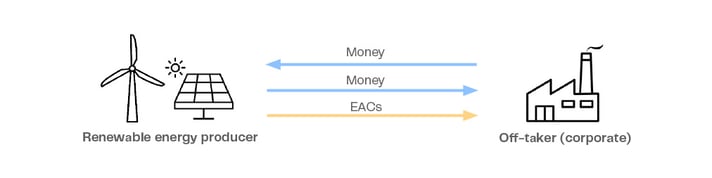

There are two basic types of PPAs: physical, where the off-taker gets actual electricity delivered, and financial, where there is no physical delivery of electricity but there is a financial settlement on the electricity spot price.

In the case of a financial PPA, money can flow both ways. If the spot electricity price is higher than agreed, the off-taker will receive money from the power producer. Conversely, if the price is lower than agreed, the off-taker must compensate the producer.

Model of a physical PPA. Power producers inject electricity into the grid, which is bundled with EACs.

Model of a financial PPA. No physical electricity is delivered, but consumers get EACs to prove the origin of their consumption.

On-site and off-site PPAs

PPAs can further be classified as on-site or off-site. On-site PPAs, also known as ‘direct wire’, rely on power plants built close to the place of consumption (for instance, solar panels on the rooftop or a wind park next to a factory) and deliver electricity by a private-use cable.

Off-site PPAs supply electricity using the public grid. In these arrangements, the consumer also receives EACs to document the renewable origin of the electricity consumed.

What is the imbalance cost?

One of the main differences between physical and financial PPAs is the imbalance cost, a fee charged by the grid operator for any difference between production and consumption. It is impossible to exactly forecast how much energy a renewable power plant ––like solar or wind–– will produce. Any mismatch will result in an imbalance fee.”

Sometimes it is difficult to see why a physical PPA is so much cheaper than a financial one, especially in some parts of South-eastern Europe. The reason is that, in a physical PPA, the buyer is responsible for the imbalance cost, whereas, in a financial PPA, the off-taker does not have to worry about this. Imbalance costs have also increased a lot over the past year and a half.

Buyers should consider the imbalance cost along with other factors. Some consumers might be able to use imbalance to their benefit, for example, by ramping up or reducing consumption depending on wind or solar production at a specific time. Off-takers should consider their flexibility to manage imbalance, the price difference between a physical and financial PPA, and how to mitigate the risk from the imbalance market.

Does my company have the right profile for a PPA?

Although PPAs have many upsides, not all corporate consumers are suited for this sort of agreement. Several variables determine if this type of arrangement is appropriate for a company.

Size

Is your electricity consumption big enough? This will be a determining factor in choosing the right renewable energy solution.

PPAs make sense at utility scale. Large consumers stand to see enormous benefits from stable energy prices. Alternatively, smaller consumers that use anything below 10 GWh per year can partner with other off-takers in a joint PPA.

Creditworthiness

Are you willing to provide a guarantee on the contract? PPAs require off-takers to provide financial assurance that they will not default on their commitments, either through their own treasury or via a bank contract. Assessing their financial capacity and the willingness to provide such assurance should be something potential off-takers take into consideration from day one.

Liberalised markets?

Companies often consume electricity in several countries and should make sure that the market in each location is liberalised, meaning that the applicable legislation allows private entities to participate in the generation and distribution of renewable energy –– a prerequisite for PPAs.

In Europe, the electricity market has been liberalised for over 20 years. However, in other locations in Southeast Asia or Latin America, this is not the case. There might also be constraints to grid usage, which could rule out off-site PPAs.

Location flexibility

PPAs are long-term commitments. This means that off-takers should be certain that they remain in their location for the duration of the contract.

Some of our businesses can be surprisingly flexible with the location of their consumption. If the market conditions change and energy prices increase, they can close a factory and move it within a couple of months. In this case, entering a decade-long agreement might not make sense. However, for companies that are tied to their physical location, stabilising their energy costs can be hugely beneficial and protect companies against sudden, business-threatening price increases.

What sectors can benefit the most from PPAs?

According to data from the Environmental Protection Agency (EPA), PPAs in the United States are heavily dominated by the telecom and technology sector. Active PPAs in the segment total close to 35 TWh. The categories that follow are fast-moving consumer goods and services, financial services, and government operations.

“Given the nature of their business and the volume of their electricity consumption, this is nothing more than what we would expect from them,” Preben Munch, Director of Corporate Sales at Ecohz, says. “That dominance, however, is less pronounced in Europe.”

Increasing scrutiny of supply chain emissions also creates opportunities for companies to enter PPAs. “Large companies are looking at their Scope 3, especially through the Science Based Targets initiative,” Munch continues. “PPAs are a good option for large companies within supply chains to comply with requirements from the companies they deliver goods and services to. Further, in certain industries where suppliers must commit to a cost of delivery over a multi-year period, stable energy prices are an advantage.”

How can Ecohz help?

Ecohz PPA advisors can tailor agreements to your company’s needs. Evaluating all possible variables, they verify that contracts fit your goals and guide you through the legal and technical requirements.

In short, our team is here to make decabonisation easy. We put our extensive know-how at your disposal and break the complex process of entering a PPA into manageable tasks.

To see the full webinar led by Ecohz’ experts, follow this link.

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)