1. Mandatory sustainability reporting in the EU could impact Energy Attribute Certificate (EAC) markets

The long-expected sustainability reporting rules of the European Union are now operational. 2024 opens the first disclosure cycle for companies subject to the Corporate Sustainability Reporting Directive (CSRD), which, in tandem with the Sustainable Investment Taxonomy and the Green Claims Directive, builds a new framework for business sustainability within the EU.

Energy Attribute Certificates (EACs) will underpin corporate reporting. The CSRD mandates companies to document their energy consumption using contractual instruments. According to analysts, this may have already impacted the Guarantees of Origin (GO) market as buyers anticipate the price of GOs to rise.

As 2024 progresses, firms may also consider options to purchase renewable energy beyond Europe. The CSRD brings supply chains into focus, and International Renewable Energy Certificates (I-RECs) could see an increase in demand as a result.

The new reporting guidelines could significantly alter the EU single market. To comply, companies that now find themselves with increased obligations might seek specialised guidance before filing their first reports early next year.

2. Scope 3 will take centre stage in corporate decarbonisation

Supply chains will continue to attract attention throughout 2024. We have already seen organisations such as the Clean Energy Buyers Association (CEBA) highlight the importance of Scope 3 and even launch educational programmes on how to decarbonise global supply chains.

This will come, to an extent, out of necessity. Emerging regulation is making Scope 3 reporting mandatory. The Climate Corporate Data Accountability Act, recently passed into law in California, will make it an obligation for companies with over 1 billion dollars in annual revenue to disclose Scope 3 emissions from 2027. In Europe, companies subject to the CSRD will submit their first reports in 2025.

CEBA expects a rise in collaborations between companies and suppliers. Information and upskilling will remain in high demand as businesses grapple with the complexity of their new obligations.

3. RE100’s new criteria are now live

They were announced over a year ago, but RE100’s new criteria finally came into effect at the start of 2024. Among the updated rules are a 15-year commissioning limit on power plants, more stringent rules for energy to qualify as renewable, and a redrawn market boundary for Europe.

Exactly how this will affect companies purchasing preferences remains uncertain. Some corporate buyers of renewables already follow standards that are more rigorous than RE100’s. Others may take the opportunity to purchase cheaper solutions out of the initiative’s scope.

Regardless, the guidelines raise the bar for corporate environmental action and give a wide range of companies a new benchmark to aspire to.

4. I-REC Standard grows and diversifies in environmental attribute tracking

At the end of 2023, the International REC Standard Foundation became the International Tracking Standard Foundation (I-TRAK Foundation). Thus, the organisation that oversees International Renewable Energy Certificates (I-RECs) expanded its reach to meet the growing demand for environmental attribute tracking.

The I-TRACK Foundation also launched a collection of new product codes to cover, beyond renewable electricity, “hydrogen, carbon dioxide removals and other physical carbon products, methane intensity measurements and biomethane”.

The focus of the Foundation, however, will continue to be clean electricity. And the segment is growing fast. 2022 closed with an I-REC issuance of 245 TWh, a 50% increase compared to 2021. Although we must still wait for the final numbers, 2023 is expected to continue the rising trend and exceed 300 TWh.

Expanding I-REC markets could also bolster the revenue of renewable energy producers worldwide. As more and more regulations rely on EACs and corporate buyers keep buying renewables, we can expect growth to continue.

5. The EU further incentivises Power Purchase Agreements (PPAs)

The European Council and Parliament recently agreed in principle to reform the EU’s electricity market design. The text includes an obligation for Member States to make PPAs more accessible by removing entry barriers and reducing financial risks.

While the directive force Member States to use specific mechanisms to accomplish these goals, countries must soon revise their national laws and align them with the block-wide objectives.

The Carbon Border Adjustment Mechanism (CBAM) emphasises renewable PPAs, too. Companies subject to the rules can report reduced carbon intensity by using a lower emissions factor corresponding to the type of electricity in their agreement. As the implementation of CBAM progresses, companies might seek more of these contracts to avoid paying for emissions quotas.%20smaller.png?width=1201&height=628&name=Biogas%20webinar%202(1)%20smaller.png)

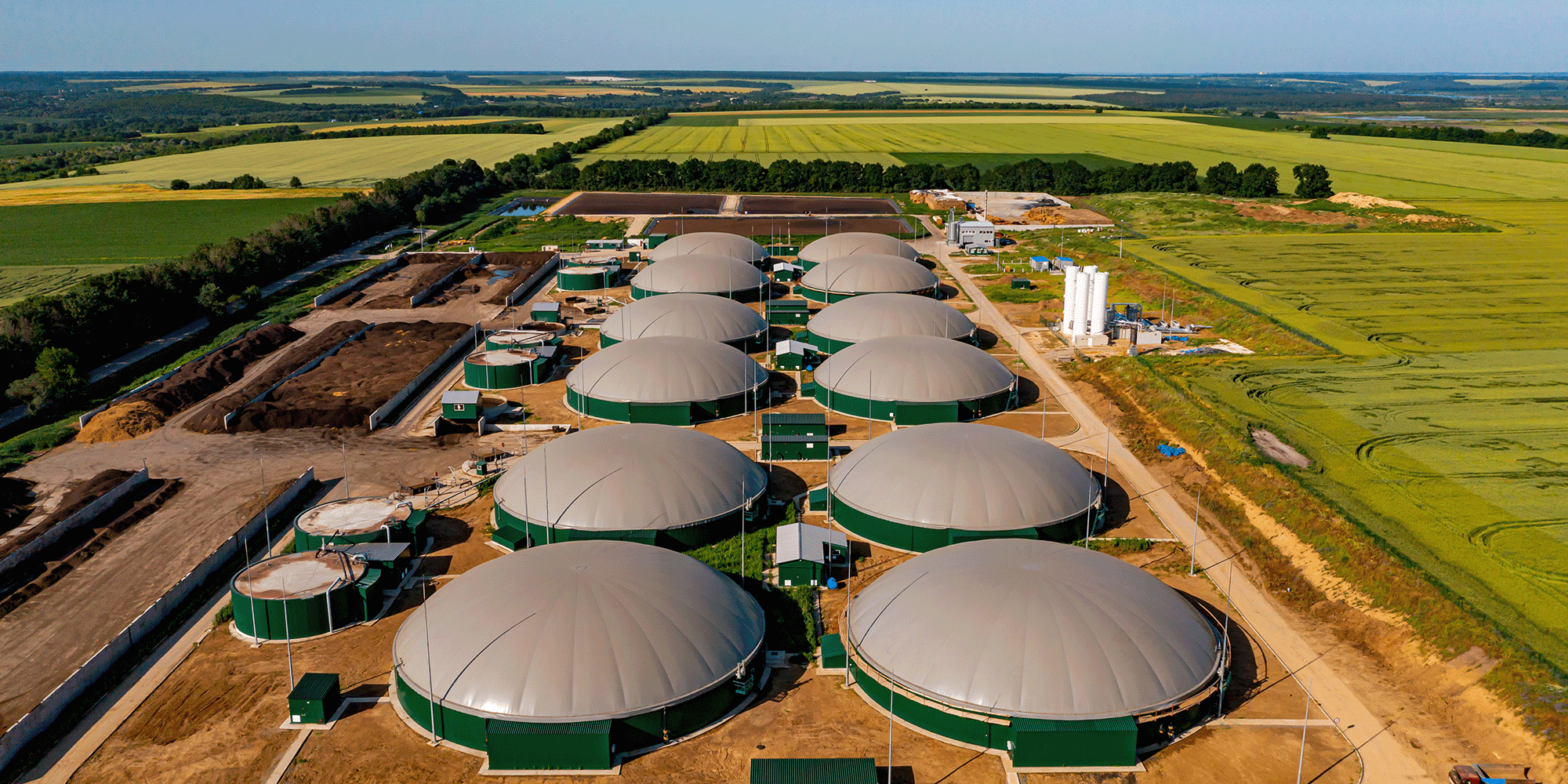

6. Biomethane: development in the European market

France, one of the largest biomethane producers in the continent, will officially enter the European market by opening for imports and exports in 2024, perhaps as soon as Q1. Prices could shift across the EU as a result.

The move is a step towards a harmonised European market – and the trend is gathering speed. AIB expects to have ten countries connected to its hub by the end of 2024.

As part of its renewable energy targets, the EU aims to reach an annual biomethane production of 350 TWh by 2030. The market will need to grow faster to achieve said goal. More transparency, ease of transactions, and other mechanisms to support demand are still required.

Renewable energy at large will continue to grow rapidly. According to a recent report by the International Energy Agency, renewables are now expanding faster than at any time in the past three decades. This year promises exciting developments in many areas of the industry.

.png?width=3840&height=2560&name=Sun(1).png)

.png?width=3840&height=2560&name=Landscape_2(1).png)